Technical Content Library

Curated by ComboCurve's experts, this resource library is designed to empower oil and gas professionals with cutting-edge strategies, best practices, and innovative perspectives.

Emerging Play- Cherokee in Western Anadarko

Basin Study

Basin Study

Mohamad Hajou explores the Cherokee in the Western Anadarko Basin, a play catching the interest of Mewbourne and Sandridge.

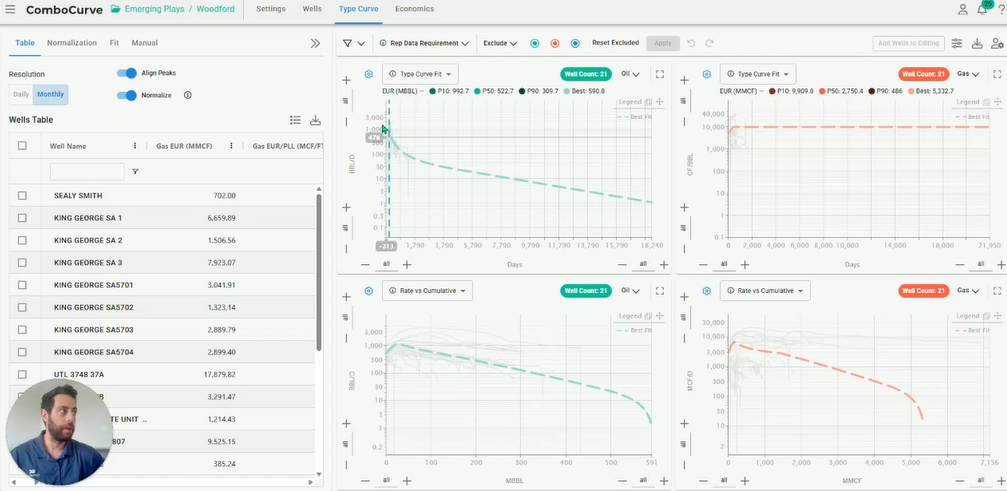

Woodford Shale in the Permian Basin Analysis

Deal Evaluation

Deal Evaluation

Mohamad Hajou uses ComboCurve to explore recent well results from Woodford Shale wells in the Permian Basin.

Baytex Eagle Ford Divest Lookback

Deal Evaluation

Deal Evaluation

Chase Gay performs a full cycle lookback on the Baytex Eagle Ford divest.

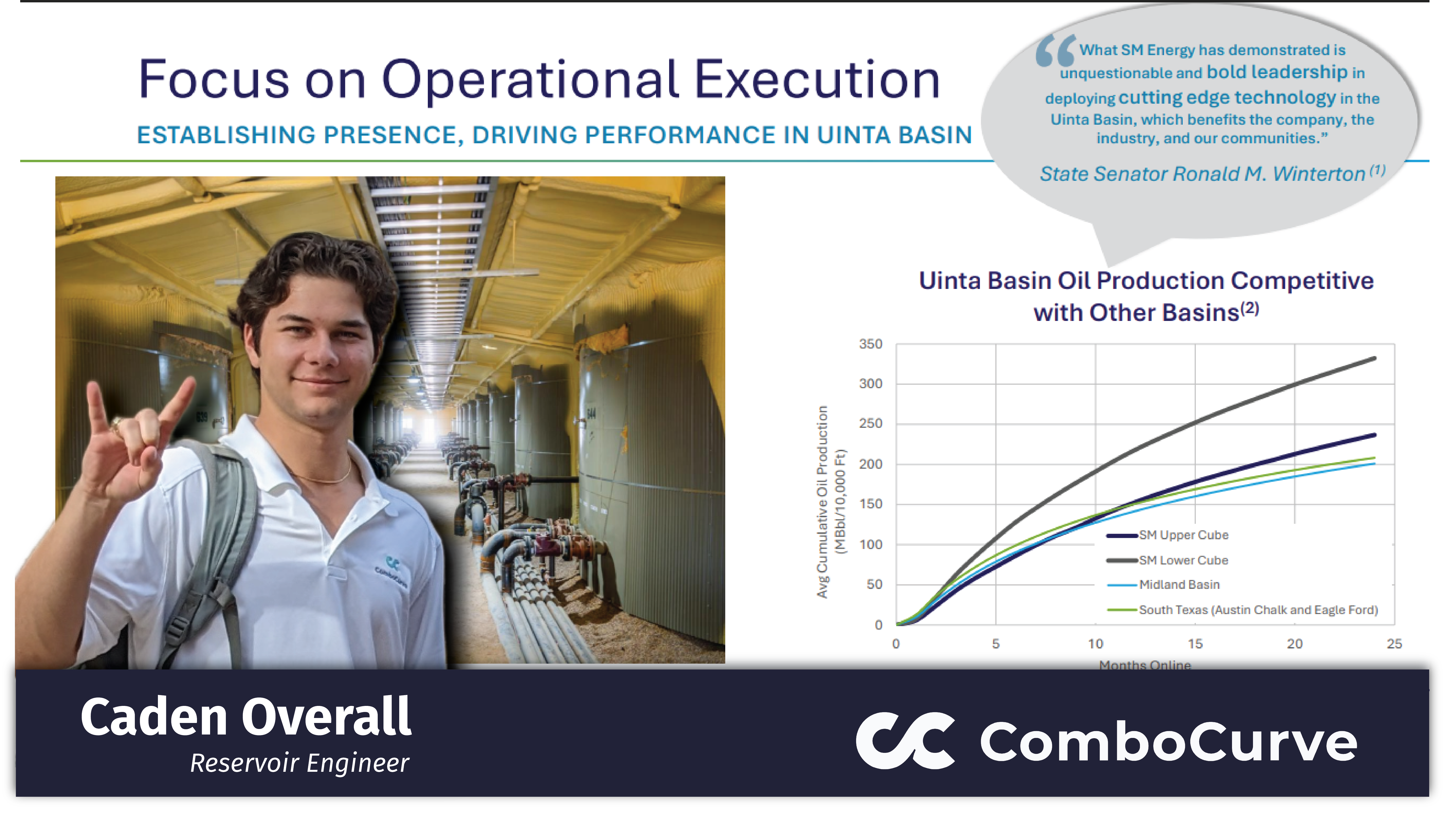

SM Uinta Basin Analysis

Economics

Economics

Caden Overall Performs a lookback on some of the stellar wells coming out of the Uinta Basin from SM Energy.

Breakdown of Antero’s Marcellus & Utica Acquisition

Deal Evaluation

Deal Evaluation

Full breakdown of the $2.8 Billion Marcellus & Utica Acquisition by Antero Resources. Chase Gay recreates this evaluation using only public production data and economic assumptions from public presentations.

Tips for Upside Evaluation in Delaware Basin

Deal Evaluation

Deal Evaluation

Matteo walks through a real deal evaluation in the Delaware Basin using public data

Atoka Wash Operated PUD Deal Evaluation

Basin Study

Basin Study

Brodee walks through a real deal evaluation of 15 undeveloped locations in the Atoka Wash in the Texas Panhandle.

Delaware Basin 2nd Bone Spring Study- Detailed

Basin Study

Basin Study

Download Delaware Basin 2nd Bone Spring Study. Collaboration with TGS to bring Reservoir Characteristics with economic evaluation.

Amplify Oklahoma Divest Lookback

Deal Evaluation

Deal Evaluation

Matteo performs a full cycle lookback on Amplify's full exit of Oklahoma.

Deal Evaluation. Frac Hit Mitigation. Refrac Potential.

Deal Evaluation

Deal Evaluation

Dylan Breaux walks through an opportunity with refrac potential. Recorded after a Lunch and Learn with EnergyNet.

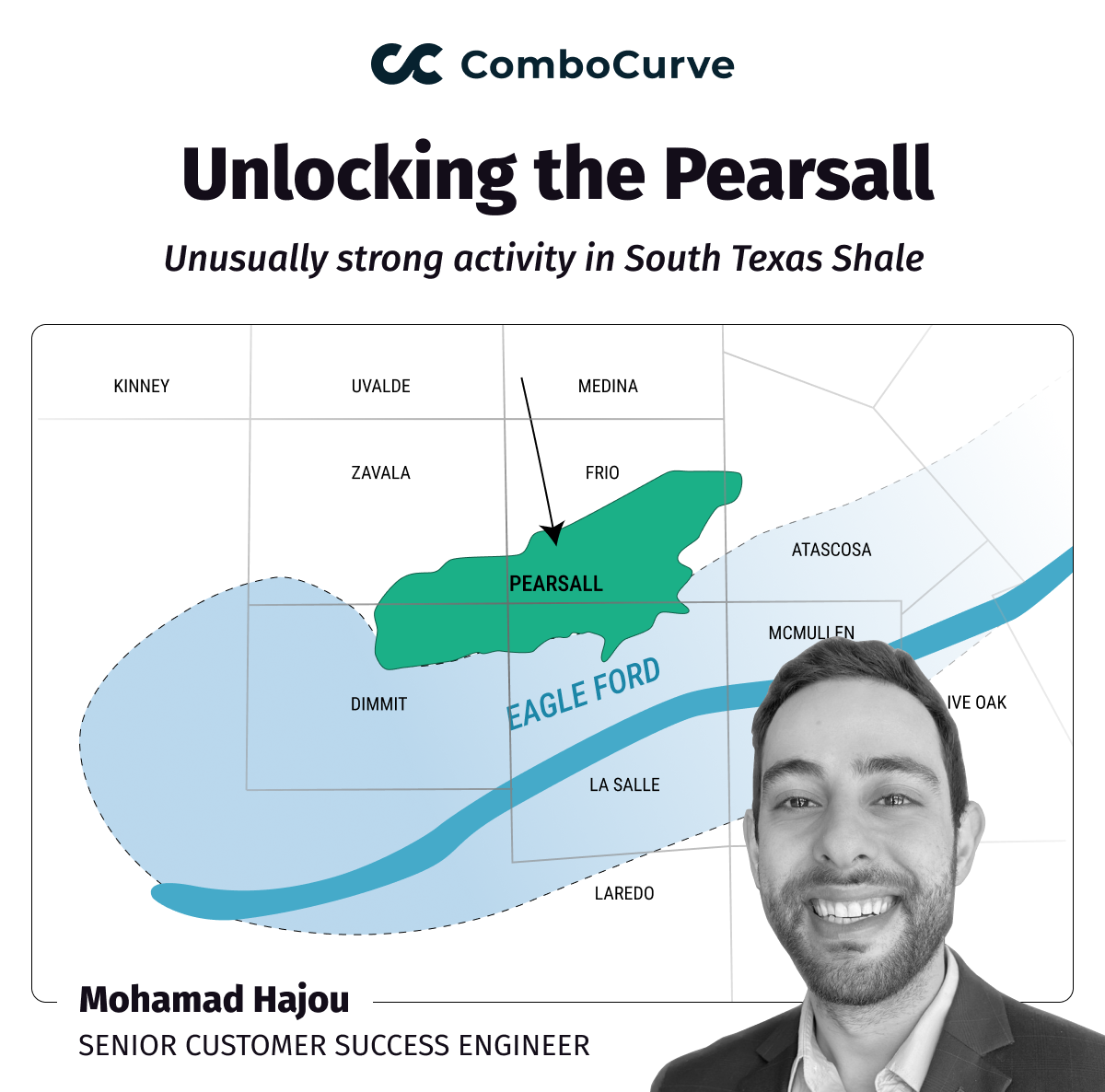

Unlocking the Pearsall Shale

Basin Study

Basin Study

Mohamad Hajou takes a detailed look at the Pearsall in ComboCurve, reviewing well performance, type curves, and how these early results compare to nearby Eagle Ford development.

Weld County Mineral Evaluation with Minimal Data

Deal Evaluation

Deal Evaluation

Matteo Caponi showcases auto-proximity to generate forecasts for low data wells in this mineral evaluation.

Multi-State Non-Op Eval (EN Lot 131008)

Deal Evaluation

Deal Evaluation

Alec Slight showcases a full ComboCurve workflow by evaluating an 84 Well Non-Op Package in Arkansas, Colorado, Louisiana, Michigan, New Mexico, Oklahoma, Texas and Wyoming.

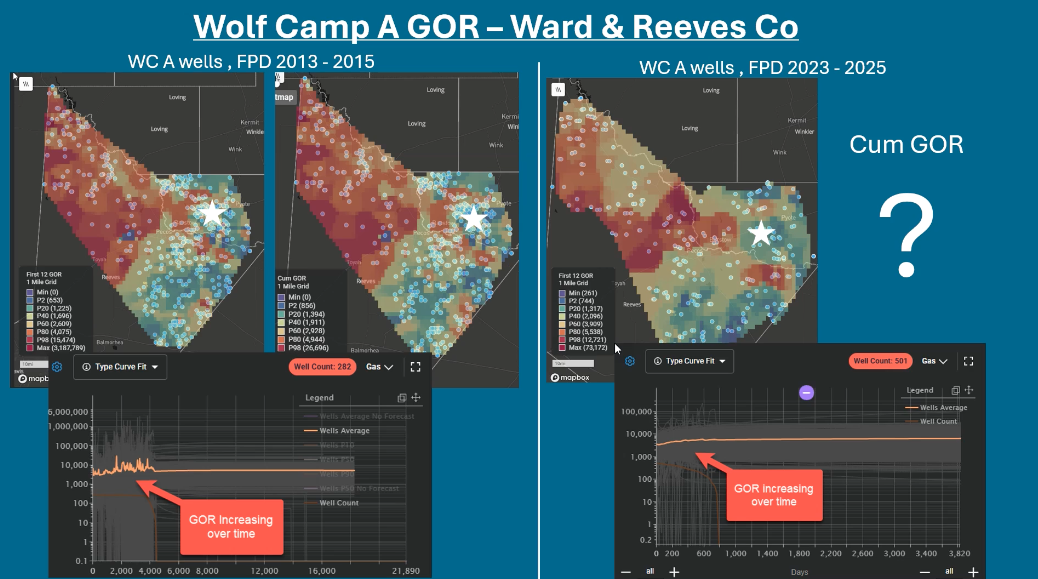

GOR Impact on Asset Valuation

Basin Study

Deal Evaluation

Basin Study,

Deal Evaluation

De-Risk in the Delaware

Deal Evaluation

Deal Evaluation,

In this video, we walk through a detailed evaluation of a mineral package in Reeves and Ward County, Texas, focusing on the current production and future potential of various wells.

Horseshoe Wells

Economics

Economics

As lateral designs evolve, operators are testing horseshoe wells to maximize acreage efficiency. But how do they compare economically to traditional one- and two-mile laterals?

Watch video

Lookbacks, Simplified

Economics

Forecast

Economics,

Forecast

Reconciling forecasts against actuals is critical for better decision-making, but traditional methods can be time-consuming.

Watch video

Midland Subbasin EUR Performance

Economics

Forecast

Deal Evaluation

Economics,

Forecast,

Deal Evaluation

Understanding EUR per foot performance is critical when evaluating developed and undeveloped acreage. In this video, we analyze Midland, Martin, and Ector County wells, uncovering key trends that influence EUR variability over time.

Watch video

Forecasting: Auto vs. Manual

Forecast

Forecast

What if you could complete a 12-hour forecasting exercise in just 2 hours? In this video, Senior Technical Engineer, Dylan Breaux takes you through how ComboCurve went head-to-head against a legacy tool, achieving an 83% time savings while delivering results within a 2% variance of the original analysis.

Watch video

Refracs in the EagleFord: Unlocking Hidden Potential

Economics

Economics

Even after over a decade of heavy activity, refracs are still up for debate in the EagleFord. Some operators are going all in, restimulating older wells that were undertreated initially while others claim that capital is better spent in new development. Watch the workflow in action.

Watch video

Normalize Type Curves While Constraining the Peak Rate

2 Factor normalization is a normalization technique used to scale the EUR and Peak rate independently from one and other. Want to see how this could significantly impact economics?

Watch video

Analyzing Terminal Decline in the Permian

Terminal decline—every engineer makes assumptions about it, but how often do we actually observe it? . Want to know if the standard 5-8% assumptions hold true?

Watch video

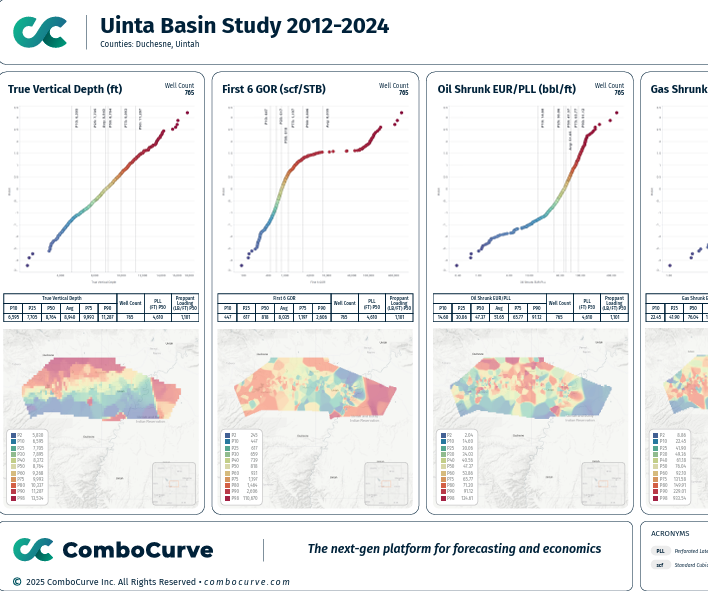

Uinta Basin Study

Basin Study

Basin Study

Would you drill where break-evens are $30 or $61? This Uinta Basin analysis might change your perspective on depth, production, and price.

Reserves Forecasting: Accuracy and Consistency

Forecast

Forecast

In this study, Trevor Owen, director of technical engineering at ComboCurve, shows how to update forecasts YOY, matching the latest production trend and maintaining the same EURs.

Watch video

How Much Are You Betting on Your B-Factor Assumption?

Economics

Economics

In this study, we put that question to the test. Using 5,000 Wolfcamp B wells, we analyzed how adjusting b-factor from 0.7 to 1.4—while holding all other parameters constant—impacts decline rates, future production, and PV-10 values.

Watch video

Deal Evaluation: Indigo Package in the Eastern Shelf

Deal Evaluation

Deal Evaluation

When opportunities like this hit the market, speed and precision matter. We ran multiple scenarios, optimized type curves, and built a waterfall chart to see how small changes in assumptions impact deal value.

Watch video

AFIT vs. BFIT

Economics

Economics

In this deep dive, we analyze the impact of several AFIT (after federal income tax) scenarios on a single development well.

Watch video

Stress-Testing EagleFord Development Plans

Economics

Economics

Optimizing a development plan is hard. Activity level impact on key economic indicators like NPV, IRR and free cashflow, coupled with price uncertainty make it imperative to run a number of scenarios to make an informed decision.

Watch video

Refrac Potential in the EagleFord

Deal Evaluation

Deal Evaluation

Even after a decade of intense activity, the effectiveness of refracs in the Eagle Ford remains a hot topic. While some operators aggressively restimulate older, undertreated wells, others question whether capital is better allocated to new development.

Watch video

Premier Delaware Basin Non-Op Acreage

Deal Evaluation

Deal Evaluation

Watch Trevor Owen, Director of Technical Engineering at ComboCurve, dig into the 151 PDP wells and 41 in-progress locations and look for potential upside.

Watch video

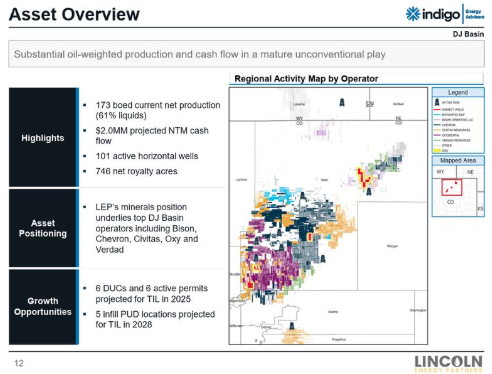

DJ Basin Minerals & Royalty Interest

Deal Evaluation

Basin Study

Deal Evaluation,

Basin Study

With a heavy weighting toward future development, this deal presents both risk and upside. VP of Customer Experience Allyson Kidwell looked at varying future well timing and production as compared to the sellers case.

Watch video

Run Economics & Sensitivities Faster with ComboCurve

Economics

Watch video

Economics

Delaware Basin Production Trends

Basin Study

Basin Study

How have well designs evolved in the Delaware Basin, and which areas continue to deliver top-tier performance?

Watch video

EnergyNet Lot 120320: Premier Delaware Basin Non-Op Acreage

Deal Evaluation

Deal Evaluation

Watch Trevor Owen dig into the 151 PDP wells and 41 in-progress locations and look for potential upside.

Watch video

Breaking Down a Delaware Basin Deal

Deal Evaluation

Deal Evaluation

In the latest ComboCurve Deal Evaluation Series, we analyze an operated and non-operated PDP package from Mongoose Energy listed on EnergyNet as Lot Number 125598.

Watch video

Bakken Terminal Decline Assumptions

Basin Study

Basin Study

ComboCurve Engineer Matteo Caponi analyzed 12,000+ Bakken wells to compare a flat 8% assumption vs. data-driven terminal decline rates.

Ownership Reversions: Carried Interest

Economics

Economics

For teams looking to stay active while scaling back CAPEX exposure, farm-outs and carried interest structures are one way to stay agile without sitting on the sidelines.

Tornado Plots

Economics

Economics

One chart. Maximum clarity. Tornado plots expose your biggest risks and opportunities. When you're juggling forecast, pricing, CapEx, and timing, tornado plots help isolate what really drives value.

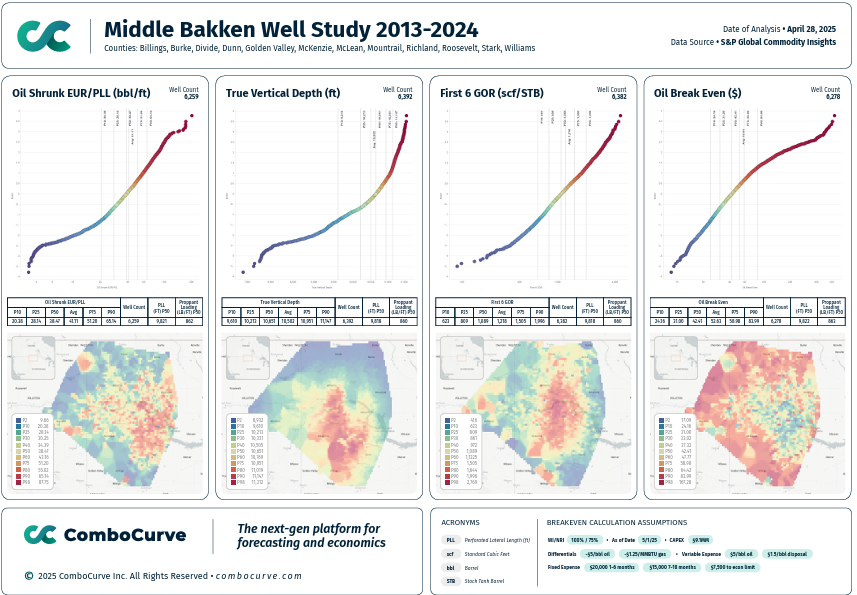

Middle Bakken Well Study 2013-2024

Middle Bakken Well Study 2013-2024

Uinta Basin Study 2012-2024

Basin Study

Basin Study

Uinta Basin Study 2012-2024

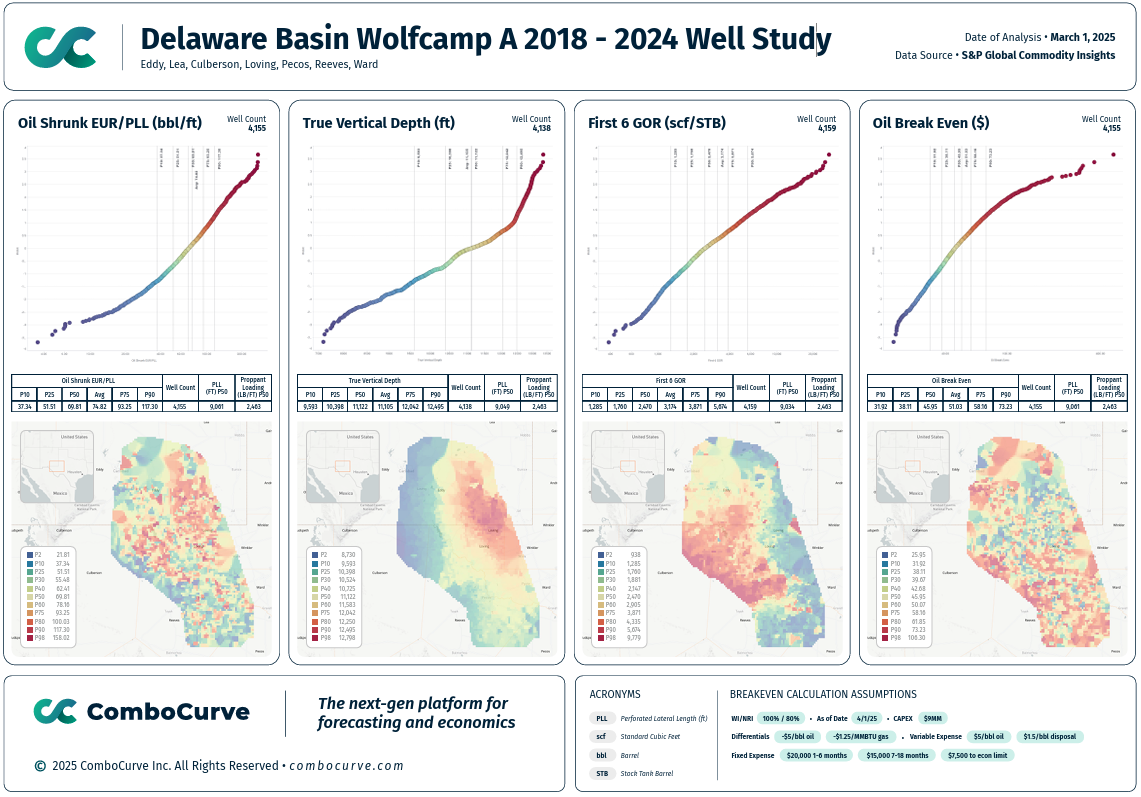

Delaware Basin Wolfcamp A 2018 - 2024 Well Study

Basin Study

Basin Study

Delaware Basin Wolfcamp A 2018 - 2024 Well Study

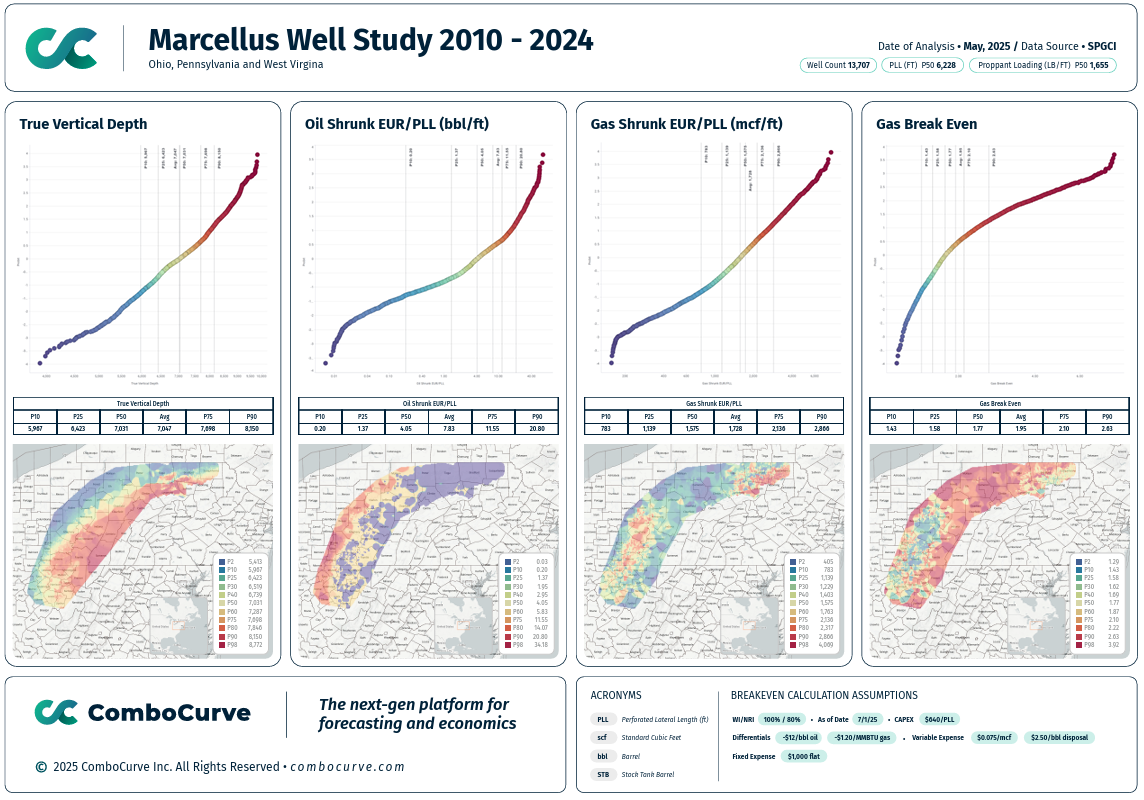

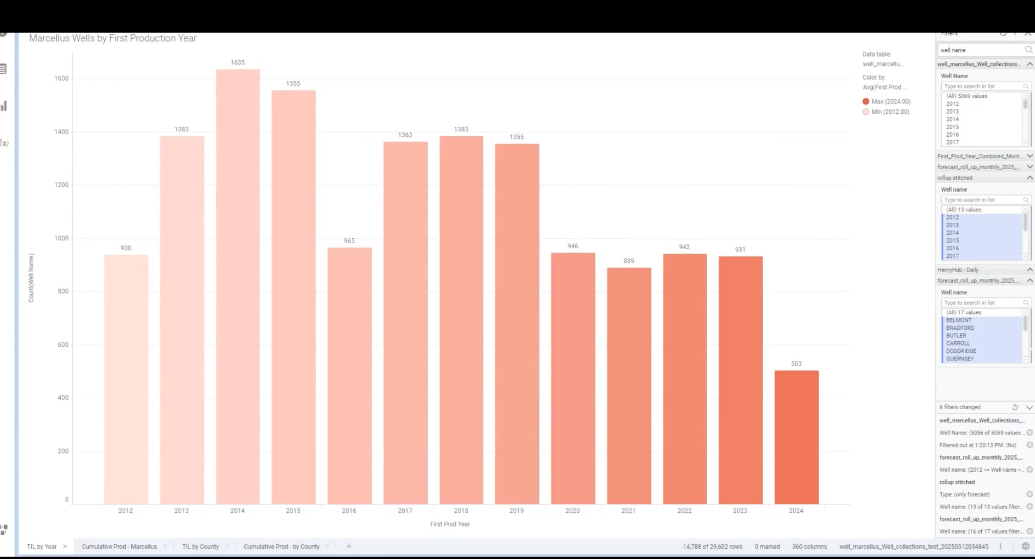

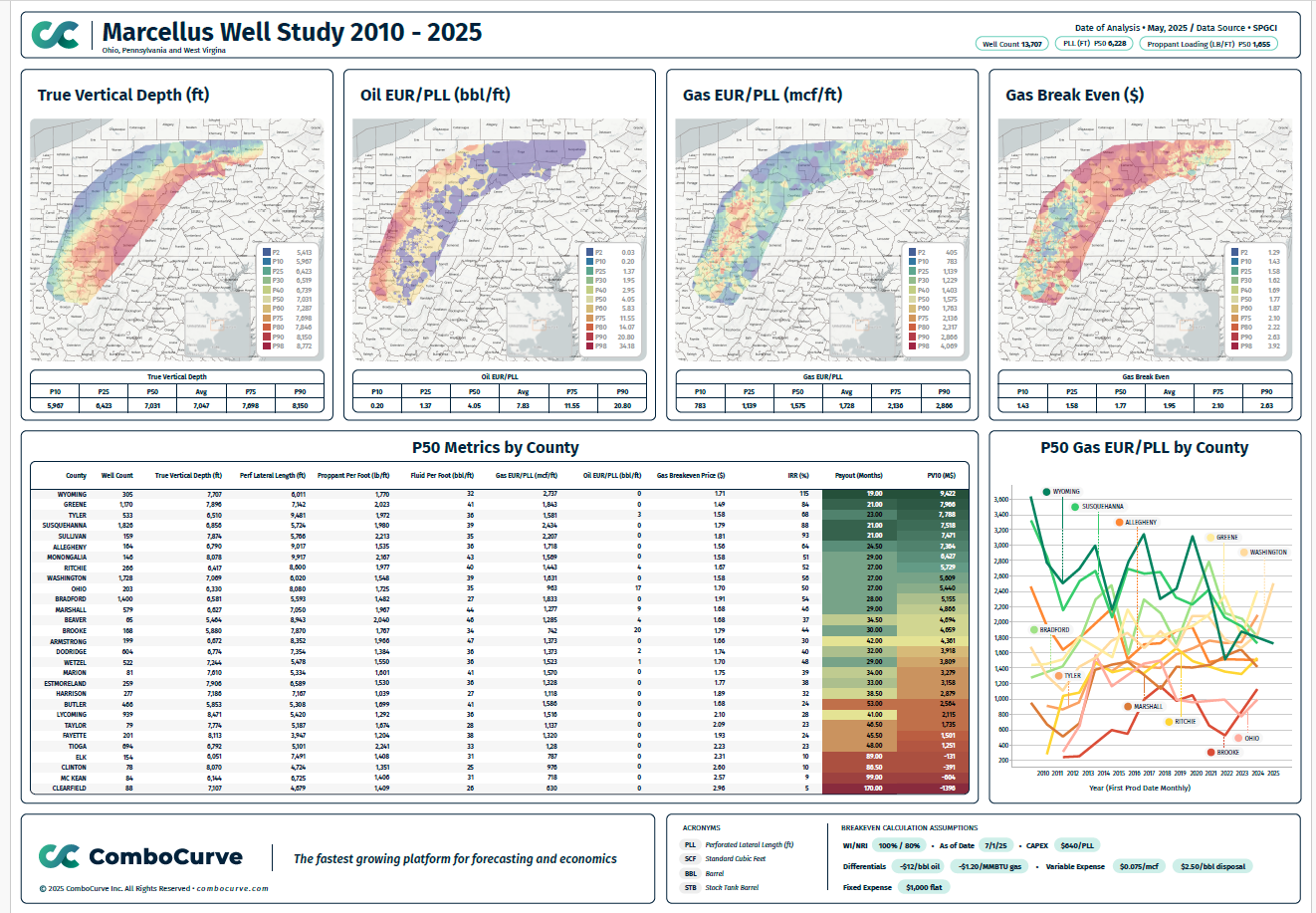

Marcellus Well Study 2010 - 2024

Basin Study

Basin Study

Marcellus Well Study 2010 - 2024

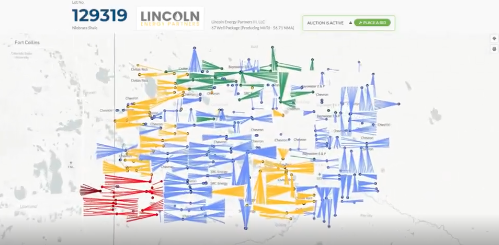

EnergyNet Listing 129319

67 Well Mineral Package in Weld County, Colorado. Bids Due August 19, 2025

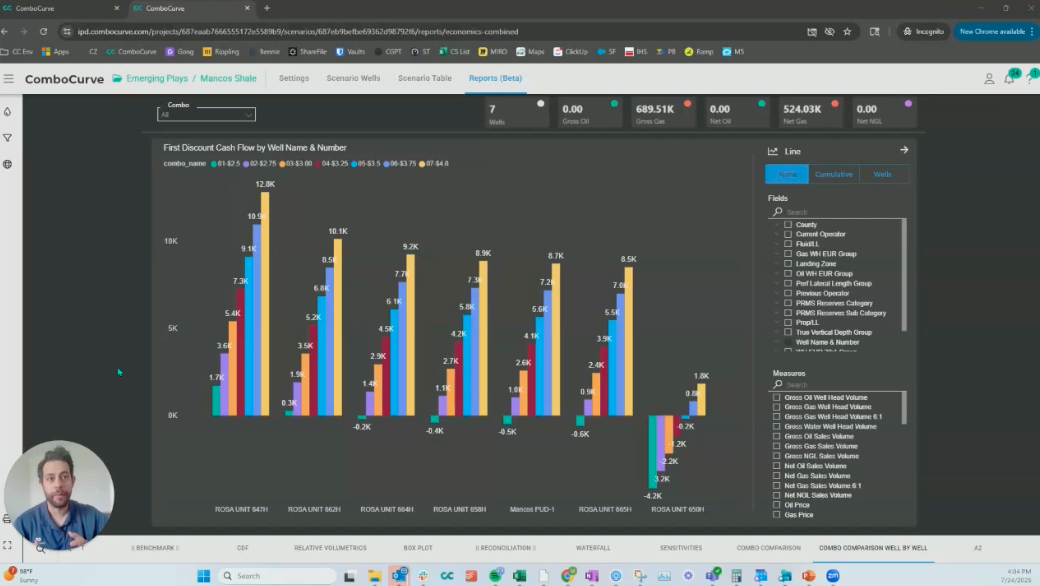

Does the Mancos Shale compete?

Basin Study

Basin Study

Just a $0.50 swing in gas price shifted Mancos Shale economics from marginal to highly attractive.

Evaluating an Asset with Type Curves, Production Forecasting & Full Economic Analysis

In this video, we walk through a live asset listed on Indigo (Lot #129312), demonstrating how to evaluate a real opportunity by building type curves, forecasting production, and running full economic analyses.

GOR Impact on Asset Valuation

Basin Study

Basin Study

GOR uncertainty can make or break your upside - especially in gassy benches like Wolfcamp C & D. Check out how we show how GOR variability impacts economics.

12 wells per section = higher recovery, lower returns.

Basin Study

Basin Study

In this DJ Basin spacing study, a ComboCurve engineer breaks down why tighter development isn’t always the best answer.

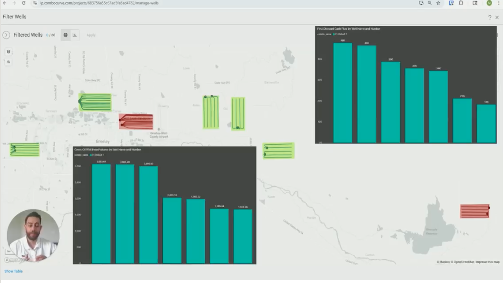

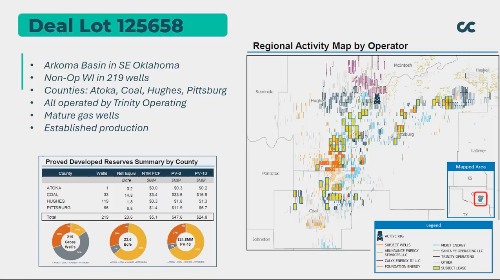

PV10 Compression: Inside the Arkoma Basin Evaluation

PV10 dropped 15% from seller to buyer assumptions - watch this video and find out why.

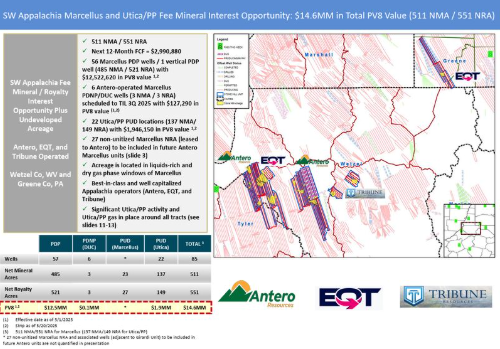

WV and PA Marcellus and Utica/PP Fee Mineral/Royalty Interest Opportunity

Deal Evaluation

Deal Evaluation

We broke down EnergyNet Lot 126564 in ComboCurve—551 net royalty acres, 656 Marcellus PDPs, 6 DUCs, and 22 Utica pods.

EnergyNet Listing 129824

Deal Evaluation

Deal Evaluation

Indigo Energy Advisors has an intriguing opportunity in the Western Haynesville. If you haven’t had time to review the package yet, watch Fernando Torres walk through the evaluation process in ComboCurve.

Group Forecasting by County and Vintage in Marcellus

Forecast

Forecast

We pulled >14,000 wells and grouped them by first production year and by county to analyze decade-long trends in the basin. Watch this video to see what stood out.

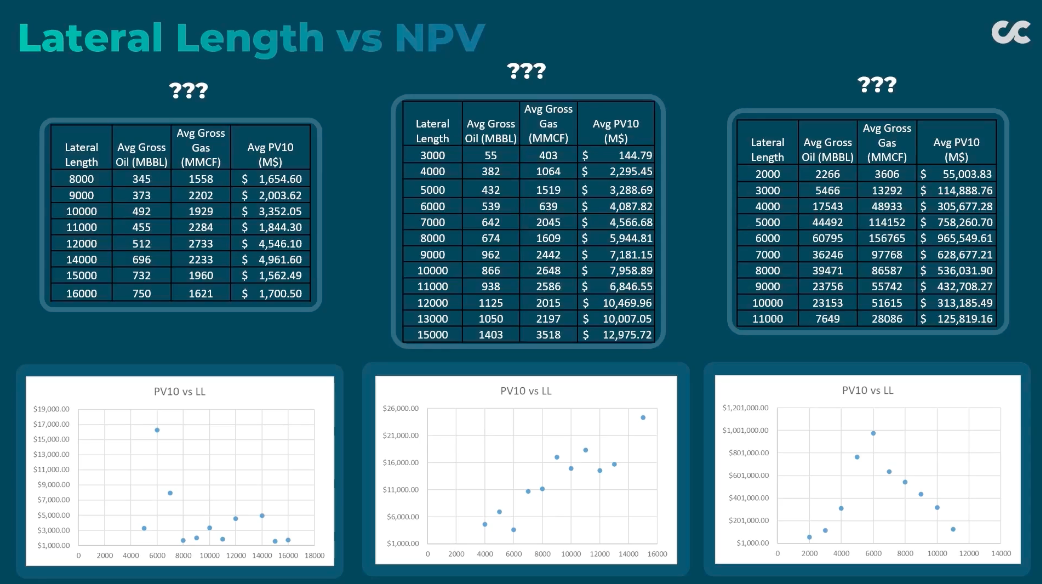

Lateral Length vs NPV

2,000 extra feet. Is it always worth it? ComboCurve engineer Katie Etlinger ran basin-specific economic models in ComboCurve to test whether longer laterals actually deliver better value, or just higher costs.

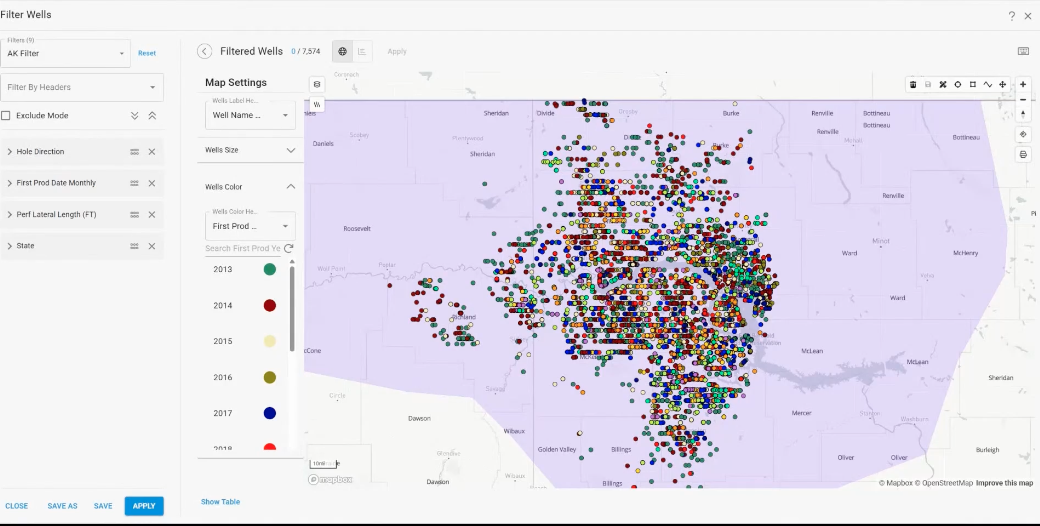

Williston Basin Study

Basin Study

Basin Study

In this basin analysis, VP of Customer Success Allyson Kidwell uses Spotfire + ComboCurve outputs to map the evolution of the Middle Bakken—tracking production, completions, and economics across 6,000+ wells.

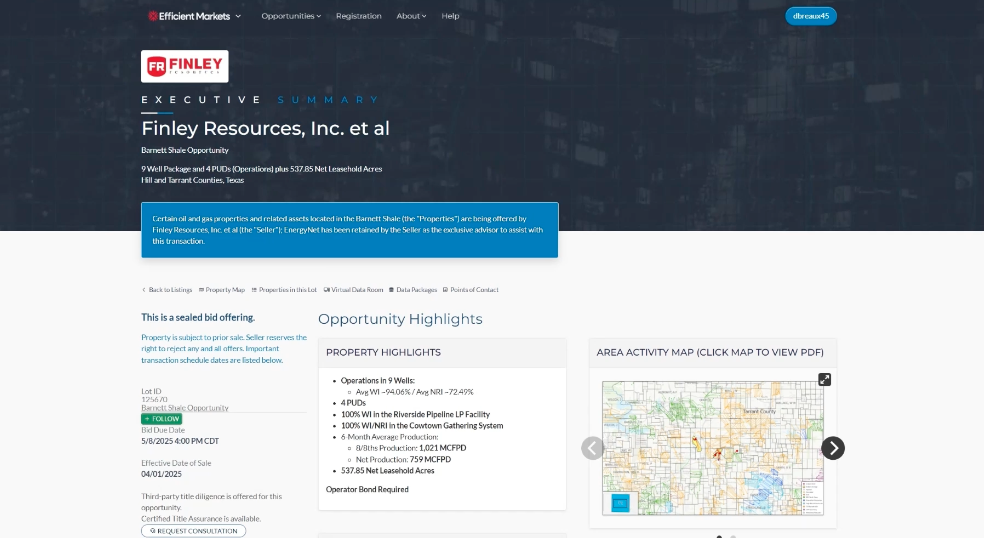

Barnett Package Deal Evaluation

Matteo dives into the forecasts, models economic cutoffs of the 9 wells, and runs sensitivities on PUD economics based on gas price.

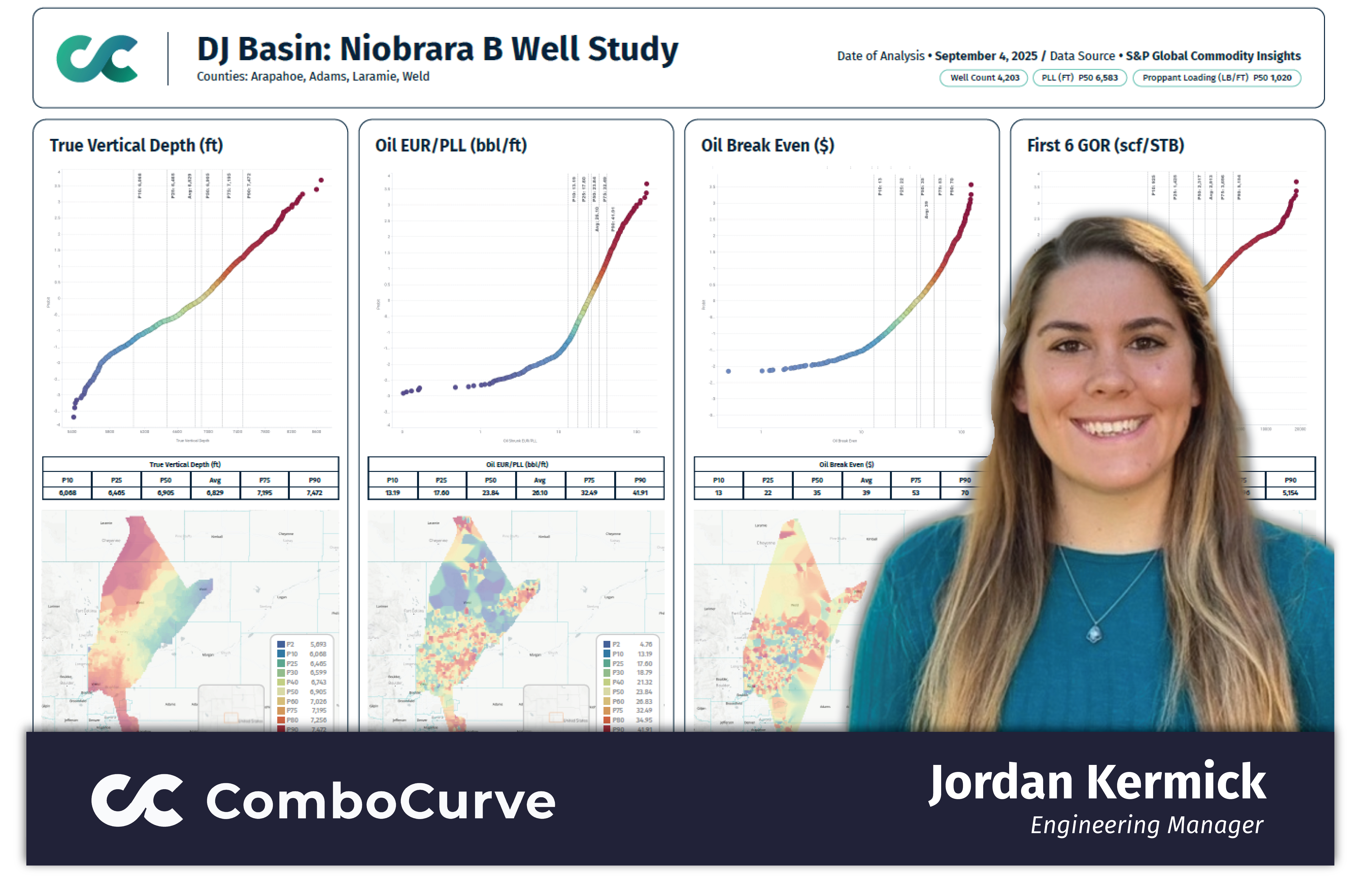

DJ Basin Deep Dive

Basin Study

Basin Study

In this deep dive, Jordan Kermick explores where capital is flowing, which benches are performing best, and what the latest well data reveals about the future of the DJ.

Marcellus Basin Study Expanded

Expanded version of the Marcellus Basin Study Poster with P50 breakouts by County.

Midland Basin Wolfcamp B Study

Basin Study

Basin Study

Download Midland Basin Wolfcamp B Poster with breakouts by County

How to Evaluate Non-Op Undeveloped Acreage in the Permian

Economics

Economics

Fernando shows a step by step evaluation of Non-Op Acreage in the Permian Basin.

Emerging Play- Sycamore in the SCOOP

Basin Study

Basin Study

Mohamad Hajou explores the Sycamore in the Southern Scoop, a play seeing a resurgence with modern completions.

Delaware Basin 2nd Bone Spring Study

Basin Study

Basin Study

Download Delaware Basin 2nd Bone Spring Study. Probit Plots and heatmaps generated with ComboCurve Analysis

Oklahoma Non-Op Evaluation Start to Finish

Deal Evaluation

Deal Evaluation

Fernando takes a package spanning several counties across Oklahoma and generates a buyer versus seller case in ComboCurve.

JERA $1.5B Haynesville Acquisition Lookback

Deal Evaluation

Deal Evaluation

Andrew performs a full cycle lookback on the recent Haynesville Acquisition by JERA. Pricing and operational sensitivities included.

Sorry, no results found.

Try refining your search or checking for typos.